If you are self-employed and looking to reduce your tax burden you are in luck, you have come to the right place.

Being self-employed in Cyprus can be a challenging but rewarding career choice, and Cyprus is a great place to pursue it. The island in the eastern Mediterranean is known for its sunny weather, beautiful beaches, and vibrant culture. But beyond its tourism industry, Cyprus has a thriving economy that offers many opportunities for entrepreneurs and freelancers.

In this article, we will explore the benefits of being self-employed in Cyprus, including financial advantages, flexible work arrangements, and a supportive business environment.

Table of Contents

ToggleFlexible Work Arrangements

Another benefit of being self-employed in Cyprus is the flexibility it offers. As a self-employed individual, you have more control over your schedule and can choose when, where, and how you work. This flexibility can be especially appealing to those who want to balance work with other commitments, such as family or personal pursuits.

In addition, the rise of remote work has made it easier than ever for self-employed individuals to work from anywhere in the world. Cyprus is well-connected with high-speed internet, making it a great place to set up a home office or co-working space. Plus, with its warm climate and scenic landscapes, Cyprus offers plenty of opportunities for outdoor work and inspiration.

Supportive Business Environment for self-employed in cyprus

Cyprus is known for its entrepreneurial spirit and supportive business environment. The government has implemented various measures to attract and support startups and small businesses. It is hard to imagine any other country with such rate of entrepreneurs who are always ready to share their knowledge, experience over a cup of coffee or a glass of beer.

Moreover, Cyprus is a member of the European Union, providing self-employed individuals with access to a large market of customers and business partners. This membership also means that Cyprus adheres to EU regulations and standards, giving businesses the confidence to operate in a stable and predictable environment.

Financial advantages for self-employed workers in Cyprus

One of the biggest advantages of being self-employed in Cyprus is the financial benefits. The main taxes the self-employed would have to pay are:

Social Security contributions for self-employed workers in Cyprus

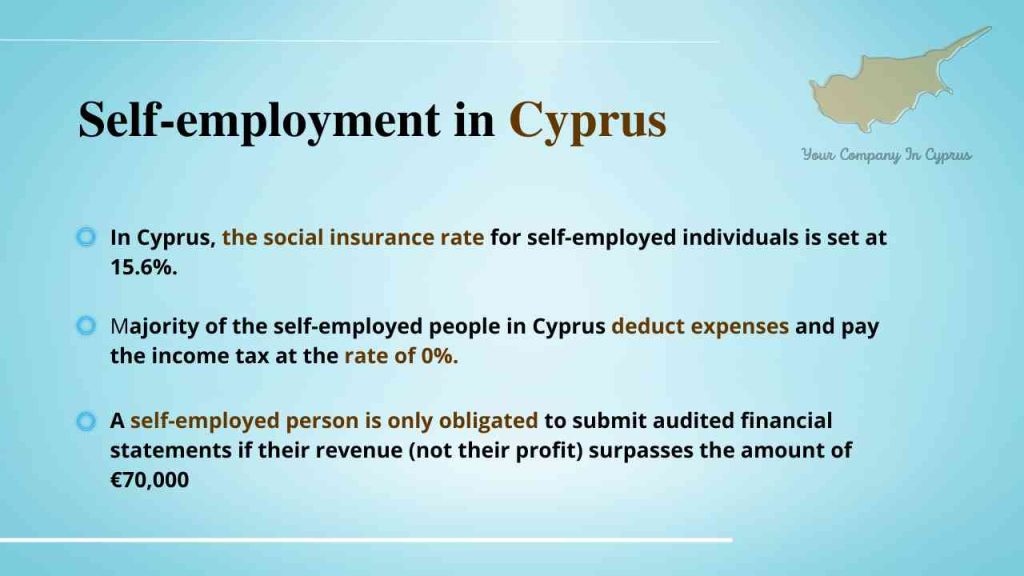

In Cyprus, the social insurance rate for self-employed individuals is set at 15.6%. It is important to note, however, that this percentage is calculated based on your ‘estimated earnings’ rather than your actual earnings.

The amount of your ‘estimated earnings’ is determined by the tax department on an annual basis, taking into account your years of experience and field of occupation.

Nonetheless, there is an opportunity to file a special application and request to be taxed based on your actual income. This option is often exercised by individuals whose actual income is significantly lower than their estimated income.

It is worth noting that social insurance payments are due every three months.

GESY for self-employed in Cyprus

GESY is a relatively new health system of Cyprus, introduced only in 2019. The system foresees the provision of the medical services to the residents of Cyprus with the co-funding between the person, who receives the medical services and the state. Thus, for all employed and self-employed in Cyprus GESY contributions are obligatory.

Self-employed shall be charged at the rate of 4% of their remuneration. You can check more details on the medical services covered by GESY following the link.

What is the VAT in Cyprus?

In the event that your sales income, not the profit, in a period of 12 consecutive months surpasses €15.600, it is mandatory to complete the registration process with the VAT department. However, it is also possible to opt for registration voluntarily, if one wishes to do so.

The VAT payment cycle requires payment every three months. The VAT rate in Cyprus stands at 19%, though there are different rates of 9%, 5%, and 0% that are applicable for specific types of transactions.

Should you choose to register for VAT, it is worth noting that you can reclaim VAT on some purchase invoices that date back up to 3 years before the registration date. It is also important to remember that the VAT tax falls under the authority of the Ministry of Economy.

In case you would like to have a direct look at the VAT legislation, you can visit the tax department’s website by clicking on the link.

Income tax for tax residents in Cyprus

Cyprus has a progressive income tax rate. The same tax rate will be applied to the self-employed as to any other individual. The rates are as follows below:

| Taxable income, EUR | Income tax rates |

| 0 to 19,500 | 0% |

| 19,501 to 28,000 | 20% |

| 28,001 to 36,300 | 25% |

| 36,301 to 60,000 | 30% |

| 60,000+ | 35% |

However, when calculating the income tax, make sure you use the benefit of tax legislation, providing you the opportunity to deduct all the business-related expenses from your income.

There is no exclusive list of things that can be deducted, thus anything, that provides you the possibility to conduct your services can be included, such as the expenses on the rent, internet, phone and any other that might be justified as business related.

With the use of this rule, the majority of the self-employed people in Cyprus deduct those expenses and pay the income tax at the rate of 0%. However, for every such deduction we would recommend you consulting your tax advisor prior to doing so.

Audit for self-employed workers in Cyprus

Regardless of their income, every company is required to prepare financial statements that have been audited. However, a self-employed person is only obligated to submit audited financial statements if their revenue (not their profit) surpasses the amount of €70,000. Thus in most cases self-employed are not falling under the obligation to prepare the audit, which allows them to not to have any extra expenses on it.

In conclusion

, being self-employed in Cyprus has numerous benefits. One of the most significant advantages is the financial benefits that self-employed individuals can enjoy, including relatively low social insurance contributions, a progressive income tax rate, and the ability to deduct business expenses.

Additionally, self-employment in Cyprus offers flexibility in work arrangements, allowing individuals to balance work with personal pursuits.

The supportive business environment in Cyprus, with its entrepreneurial spirit, access to the European Union market, and government measures to attract and support startups and small businesses, is also a significant benefit. Overall, Cyprus provides a great opportunity for entrepreneurs and freelancers looking to establish themselves in a stable and supportive environment while enjoying the beautiful weather and scenery of the Mediterranean island.

if you liked this blog we invite you to visit other articles in our web site.